Bradley A. Henion (age 52)54) has been an Executive Vice President and Chief Lending Officer of ChoiceOne Bank since January 1, 2023 and a Senior Vice President and Chief Lending Officer of ChoiceOne Bank since November 2015. Prior to his employment with ChoiceOne, Mr. Henion was Market President of First Community Bank, formerly Select Bank, in Grand Rapids, Michigan. Prior to that, he worked with Greenstone Farm Credit Services and Bank of America, formerly LaSalle Bank.

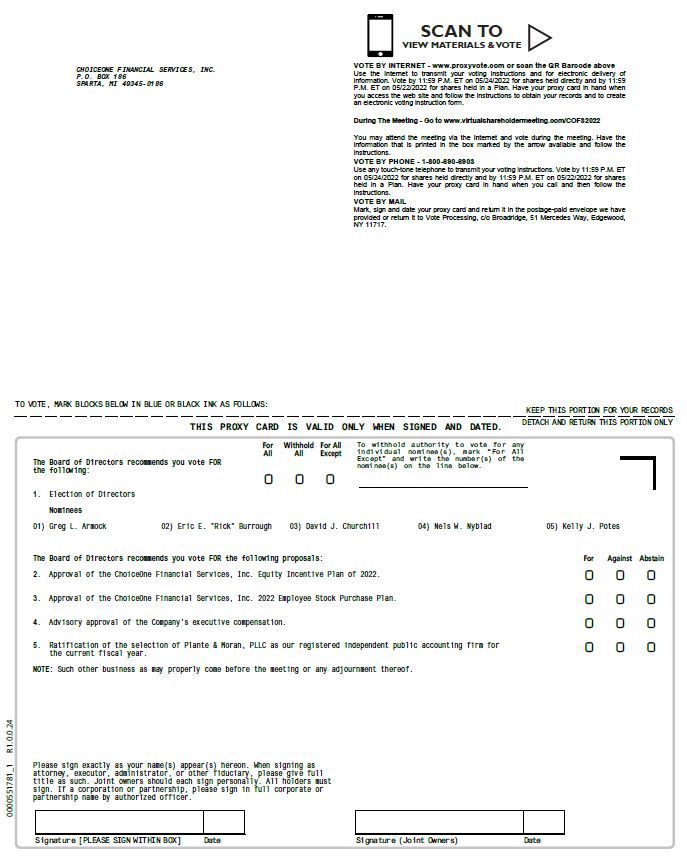

Approval of the Equity Incentive Plan of 2022

The board of directors believes that the long-term interests of ChoiceOne would be advanced by aligning the interests of its corporate and subsidiary officers and key employees with the interests of its shareholders. Therefore, to attract, retain and motivate officers and key employees of exceptional abilities, and to recognize the significant contributions these individuals have made to the long-term performance and growth of the Company and its subsidiaries, on February 23, 2022, the board of directors adopted and approved, subject to shareholder approval, the ChoiceOne Financial Services, Inc. Equity Incentive Plan of 2022 (the “Incentive Plan”). The Incentive Plan is intended to continue the compensation policies and practices of our previous equity compensation plans. Following expiration of the ChoiceOne Financial Services, Inc. Stock Incentive Plan of 2012 ("2012 Plan") on February 22, 2022, no further shares are available or will be issued under the 2012 Plan, and therefore at this time we do not have a shareholder-approved equity compensation under which we can grant equity awards to our officers and key employees. The board of directors believes that equity compensation is important for attracting and retaining talent and aligning the interests of management and our shareholders, and accordingly the board has determined that approval of the Incentive Plan is advisable.

If shareholders approve the Incentive Plan, then incentive awards could be granted to eligible participants. No incentive awards would be granted under the Incentive Plan on a date that is more than ten years after the Incentive Plan’s effective date. If the shareholders approve the Incentive Plan, the effective date of the Incentive Plan will be February 23, 2022. Incentive awards would be granted under the Incentive Plan to participants for no cash consideration or for such minimum consideration as determined by the Personnel and Benefits Committee. The Incentive Plan would not be qualified under Section 401(a) of the Internal Revenue Code and would not be subject to the Employee Retirement Income Security Act of 1974 (ERISA).

Key Reasons to Vote FOR this Proposal

Equity awards are a key part of our compensation program. We believe that equity compensation has been, and will continue to be, an integral component of our compensation package because it (i) is important for attracting and retaining talent, (ii) aligns our employees’ interests with the interests of our other shareholders, and (iii) preserves our cash resources.

The Incentive Plan provides necessary flexibility to ChoiceOne’s Personnel and Benefits Committee. We intend to use the Incentive Plan to grant long-term equity-based incentives to eligible participants. These forms of long-term incentive compensation may include stock options, stock appreciation rights, restricted stock units, restricted stock, stock awards and other awards based on or related to shares of ChoiceOne common stock (collectively referred to as “incentive awards”). By combining in a single plan many types of incentives commonly used in long-term incentive compensation programs, the Incentive Plan is intended to provide the Company with a great deal of flexibility in designing specific long-term incentives to best promote the objectives of the Incentive Plan and in turn promote the interests of our shareholders.

Potential Dilution

Although the use of equity is an integral part of our compensation program, we are mindful of our responsibility to our shareholders to exercise judgment in the granting of equity awards. Potential dilution, also called “overhang,” measures the potential dilutive impact of a company's equity programs. Total potential dilution is calculated as (a) the number of shares available to be granted as future equity awards under the Incentive Plan; plus (b) the number of remaining shares available to be granted under the 2012 Plan (which is zero); plus (c) the total number of unexercised/unvested outstanding awards, divided by (d) the total number of common shares outstanding. As of March 31, 2022, assuming the addition of the shares proposed to be authorized under the Incentive Plan, ChoiceOne's total potential dilution is 3.9%.

Key Compensation Practices Reflected in the Incentive Plan

The Incentive Plan contains a number of provisions we believe are consistent with the interests of our shareholders and best corporate governance practices.

No Repricing of Incentive Awards. The Incentive Plan prohibits the repricing of incentive awards without shareholder approval.

No Liberal Share Recycling. Shares that are surrendered to pay the exercise price of an award or to satisfy tax withholding are not made available for re-grant.

No Liberal “Change in Control “Definition. No change in control will be triggered on announcement of a tender offer or mere stockholder approval of a transaction. The Incentive Plan provides that a “change in control” will not occur for purposes of the Incentive Plan until the effective time of the transaction or event giving rise to the change in control.

No Discounted Stock Options. The exercise price for a stock option may not be less than the fair market value of the underlying stock at the time the option is granted.

No “Evergreen” Provision. The Incentive Plan does not contain an “evergreen” or similar provision. It fixes the number of shares available for future grant and does not provide for any increase based on increases in the number of outstanding shares of common stock, other than for adjustments based on a limited number of corporate events, such as a stock split or stock dividend.

No Payments of Dividends and Dividend Equivalents on Unvested Incentive Awards. The Incentive Plan prohibits the payment of dividends and dividend equivalents on unvested Incentive Awards.

Minimum Vesting Period. A minimum vesting period of one year is required for all awards issued under the Incentive Plan.

Clawback. All awards under the Incentive Plan are subject to the Company’s compensation recovery or “clawback” policy.

The following is a summary of the material features of the Incentive Plan; however, it is not complete and, therefore, you should not rely solely on it for a detailed description of every aspect of the Incentive Plan. The summary is qualified in its entirety by reference to the terms of the Incentive Plan, a copy of which is attached as Appendix A to this proxy statement. Included in the summary is information regarding the effect of U.S. federal tax laws upon participants and the Company. This information is not a complete summary of such tax laws and does not discuss the income tax laws of any state in which a participant may reside, and is subject to change. Participants in the Incentive Plan should consult their own tax advisors regarding the specific tax consequences to them of participating in and receiving incentive awards under the Incentive Plan.

Description of the Equity Incentive Plan of 2022

Authorized Shares

Subject to certain anti-dilution and other adjustments, 200,000 shares of ChoiceOne common stock, no par value per share, would be available for incentive awards under the Incentive Plan. Shares of common stock authorized under the Incentive Plan could be either unissued shares, shares issued and repurchased by the Company (including shares purchased on the open market) or shares issued and otherwise reacquired by the Company.

No Liberal Share Recycling. Shares subject to incentive awards that are canceled, surrendered, modified, exchanged for substitute incentive awards, or that expire or terminate prior to exercise or vesting in full would remain available under the Incentive Plan. However, shares that are surrendered to the Company in connection with the exercise or vesting of incentive awards or the payment of tax withholding obligations or otherwise shall not remain available for re-grant under the Incentive Plan.

Unless the Incentive Plan is terminated earlier by the board of directors, incentive awards could be granted at any time before or on February 23, 2032, when the Incentive Plan will terminate according to its terms. On February 28, 2022, the last reported sales price of ChoiceOne Financial Services, Inc. common stock was $25.46.

Officers and key employees of the Company and its subsidiaries could receive incentive awards under the Incentive Plan. We anticipate that the persons who will be eligible to receive incentive awards under the Incentive Plan will be primarily officers (currently 119 persons) and certain key employees (no determination has been made as to which employees are considered “key” employees). In 2022 (the last year in which equity incentive awards were granted under the previous plan), 59 officers of the Company received awards. Additional individuals may become officers or key employees in the future and could participate in the Incentive Plan. Officers and key employees of the Company and its subsidiaries may be considered to have an interest in the Incentive Plan because they may in the future receive incentive awards under it.

No incentive awards have been granted or received under the Incentive Plan through the date of this proxy statement. Because benefits under the Incentive Plan will depend on the Personnel and Benefits Committee’s actions and the fair market value of ChoiceOne common stock at various future dates, the benefits payable under the Incentive Plan and the benefits that would have been payable had the Incentive Plan been in effect during the most recent fiscal year are not determinable.

Administration of the Incentive Plan

The Incentive Plan would be administered by the Personnel and Benefits Committee of the board of directors. The committee would be authorized and empowered to do all things that it determined to be necessary or advisable in connection with the administration of the Incentive Plan. The committee would determine, subject to the terms of the Incentive Plan, the persons to receive incentive awards, the nature and amount of incentive awards to be granted to each person , the time of each grant, the terms and duration of each grant, and all other determinations necessary or advisable for administration of the Incentive Plan. The committee could amend the terms of incentive awards granted under the Incentive Plan from time to time in any manner, subject to the limitations specified in the Incentive Plan.

Minimum Vesting

The Incentive Plan provides that any award granted under the Incentive Plan must be subject to a vesting period of at least one year.

Clawback

All incentive bonuses under the Incentive Plan are subject to the Company’s clawback policy for the recovery of incentive compensation.

No Repricing of Incentive Awards

No outstanding incentive award may be repriced, replaced, re-granted through cancellation or modified without shareholder approval if the effect of such repricing, replacement, re-grant or modification would be to reduce the base price of such incentive award to the same participants.

Types of Awards

Stock Options

The Incentive Plan would permit ChoiceOne to grant to participants options to purchase shares of ChoiceOne common stock at stated prices for specific periods of time. For purposes of determining the number of shares available under the Incentive Plan, each stock option would count as the number of shares of common stock subject to the stock option. Certain stock options that may be granted under the Incentive Plan may qualify as incentive stock options as defined in Section 422 of the Internal Revenue Code.

The Personnel and Benefits Committee would establish the terms of individual stock option grants in stock option agreements, certificates of award or both. These documents would contain terms and conditions that the committee determines to be advisable, including vesting requirements to encourage long-term ownership of shares. The exercise price of a stock option would be determined by the Personnel and Benefits Committee, but must be at least 100% of the market value of ChoiceOne common stock on the date of grant.

When exercising all or a portion of a stock option, a participant could pay the exercise price with cash or, if permitted by the Personnel and Benefits Committee, shares of ChoiceOne common stock, or other consideration substantially equal to cash. The committee could also authorize payment of all or a portion of the exercise price in the form of a promissory note or other deferred payment installments, except as limited by the Sarbanes-Oxley Act of 2002, other laws, rules or regulations, or the Incentive Plan. Any promissory note or deferred payment must be with full recourse and at the market rate of interest. The board of directors could restrict or suspend the power of the committee to permit such loans, however, and could require that adequate security be provided. In addition, the Personnel and Benefits Committee may implement a program for broker-assisted cashless exercises of stock options.

Although the term of each stock option would be determined by the Personnel and Benefits Committee, no stock option would be exercisable under the Incentive Plan after ten years after the date it was granted. Stock options generally would be exercisable for limited periods of time if an option holder dies, becomes disabled, retires (as defined in the Incentive Plan), or voluntarily leaves his or her employment, but only to the extent the option holder was entitled to exercise the stock options on the date of such event and not beyond the original term of the stock options. If an option holder is terminated for cause, the option holder would forfeit all rights to exercise any outstanding stock options.

Stock options granted to a participant would “vest” (i.e., the options would become exercisable) in the manner and at the times that the Personnel and Benefits Committee determines; subject, however, to the requirement that any award of stock options must be subject to applicable minimum one year vesting requirements in accordance with the Incentive Plan.

Without Personnel and Benefits Committee approval, stock options granted under the Incentive Plan generally could not be transferred, except by will or by the laws of descent and distribution, unless transfer is permitted by the terms of the grant or the applicable stock option agreement. The committee could impose other restrictions on shares of common stock acquired through a stock option exercise.

Stock Appreciation Rights

The Incentive Plan would also permit the Personnel and Benefits Committee to grant stock appreciation rights. A stock appreciation right permits the holder to receive the difference between the market value of a share of common stock subject to the stock appreciation right on the exercise date of the stock appreciation right and a “base” price set by the Personnel and Benefits Committee. Under the Incentive Plan, the per-share base price for exercise or settlement of stock appreciation rights must be equal to or greater than the market value of such shares on the day before the date the stock appreciation rights are granted. Stock appreciation rights would be exercisable on dates determined by the Personnel and Benefits Committee at the time of grant.

Stock appreciation rights would be subject to terms and conditions determined by the Personnel and Benefits Committee. A stock appreciation right could relate to a particular stock option and could be granted simultaneously with or subsequent to the stock option to which it relates. Except to the extent otherwise provided in the Incentive Plan or the grant, (i) stock appreciation rights not related to a stock option would be subject to the same terms and conditions applicable to stock options under the Incentive Plan, and (ii) all stock appreciation rights related to stock options granted under the Incentive Plan would be granted subject to the same restrictions and conditions and would have the same vesting, exercisability, forfeiture and termination provisions as the stock options to which they relate and could be subject to additional restrictions and conditions. When stock appreciation rights related to stock options are exercised, such stock options are automatically cancelled with respect to an equal number of underlying shares. Unless the Personnel and Benefits Committee determines otherwise, stock appreciation rights could be settled only in shares of common stock or cash. For purposes of determining the number of shares available under the Incentive Plan, each stock appreciation right would count as one share of common stock, without regard to the number of shares, if any, that are issued upon the exercise of the stock appreciation right and upon such payment.

Restricted Stock and Restricted Stock Units

The Incentive Plan would also permit the Personnel and Benefits Committee to award restricted stock and restricted stock units, subject to the terms and conditions set by the committee that are consistent with the Incentive Plan. Shares of restricted stock are shares of common stock the retention, vesting and/or transferability of which is subject, for specified periods of time, to such terms and conditions as the Personnel and Benefits Committee deems appropriate (including continued employment and/or achievement of performance goals established by the committee). Restricted stock units are incentive awards denominated in units of common stock under which the issuance of shares of common stock is subject to such terms and conditions as the Personnel and Benefits Committee deems appropriate (including continued employment and/or achievement of performance goals established by the committee). For purposes of determining the number of shares available under the Incentive Plan, each restricted stock unit would count as the number of shares of common stock subject to the restricted stock unit. Unless determined otherwise by the Personnel and Benefits Committee, each restricted stock unit would be equal to one share of ChoiceOne common stock and would entitle a participant to either shares of common stock or an amount of cash determined with reference to the value of shares of common stock.

As with stock option grants, the Personnel and Benefits Committee would establish the terms of individual awards of restricted stock and restricted stock units in award agreements or certificates of award. Restricted stock and restricted stock units granted to a participant would “vest” (i.e., the restrictions on them would lapse and the stock would become exercisable) in the manner and at the times that the Personnel and Benefits Committee determines; subject, however, to the requirement that any award must be subject to applicable minimum one year vesting requirements in accordance with the Incentive Plan.

Unless the Personnel and Benefits Committee otherwise consents or permits or unless the terms of a restricted stock agreement or award provide otherwise, if a participant’s employment is terminated during the restricted period (i.e., the period of time during which restricted stock or a restricted stock unit is subject to restrictions) for any reason other than death, disability or retirement (as defined in the Incentive Plan), each restricted stock and restricted stock unit award of the participant still subject in full or in part to restrictions at the date of such termination would automatically be forfeited and returned to ChoiceOne. If the participant’s employment is terminated during the restricted period because of death, disability or retirement, then the restrictions on the participant’s shares of restricted stock and restricted stock units would terminate automatically with respect to that respective number of such shares or restricted stock units (rounded to the nearest whole number) equal to the respective total number of such shares or restricted stock units granted to such participant multiplied by the number of full months that have elapsed since the date of grant divided by the total number of full months in the respective restricted period except where subject to the attainment of performance goals. All of the remaining shares of restricted stock and restricted stock units would be forfeited and returned to ChoiceOne; however, the Personnel and Benefits Committee could, either before or after a participant dies, becomes disabled or retires, waive the restrictions remaining on any or all of his or her remaining shares of restricted stock and restricted stock units.

Without Personnel and Benefits Committee authorization, until restricted stock or restricted stock units vest, the recipient of the restricted stock or restricted stock units would not be allowed to sell, exchange, transfer, pledge, assign or otherwise dispose of restricted stock or restricted stock units other than by will or the laws of descent and distribution. All rights with respect to restricted stock and restricted stock units would only be exercisable during a participant’s lifetime by the participant or his or her guardian or legal representative. The Personnel and Benefits Committee could impose additional restrictions on shares of restricted stock and restricted stock units. Except for restrictions on transferability and risks of forfeiture, holders of restricted stock would enjoy all other rights of a shareholder with respect to the restricted stock, including dividend and liquidation rights and full voting rights. Holders of restricted stock units would enjoy dividend and liquidation rights with respect to shares of common stock subject to unvested restricted stock units, but would not enjoy voting rights with respect to such shares. Unless the Personnel and Benefits Committee determines otherwise, or the restricted stock or restricted stock unit agreement or grant provide otherwise, any noncash dividends or distributions paid with respect to shares of unvested restricted stock and shares of common stock subject to unvested restricted stock units would be subject to the same restrictions and vesting schedule as the shares to which such dividends or distributions relate.

Stock awards

The Incentive Plan would also permit the Personnel and Benefits Committee to make stock awards. A stock award of ChoiceOne common stock would be subject to terms and conditions set by the Personnel and Benefits Committee at the time of the award. Stock award recipients would generally have all voting, dividend, liquidation and other rights with respect to awarded shares of ChoiceOne common stock. However, the committee could impose restrictions on the assignment or transfer of common stock awarded under the Incentive Plan.

The Personnel and Benefits Committee would establish the terms of individual stock awards in award agreements or certificates of award. The stock awards would vest in the manner and at the times that the Personnel and Benefits Committee determines; subject, however, to the requirement that any award must be subject to applicable minimum one year vesting requirements in accordance with the Incentive Plan.

Other Stock-Based Awards

The Incentive Plan would also permit the Personnel and Benefits Committee to grant a participant one or more types of awards as Performance Share Awards based on or related to shares of ChoiceOne common stock, other than the types described above. Any such awards would be subject to terms and conditions as the Personnel and Benefits Committee deems appropriate, as set forth in the respective award agreements and as permitted under the Incentive Plan.

Performance Share Awards

Finally, the Incentive Plan would also permit the Personnel and Benefits Committee to grant any of the types of awards discussed above subject to performance measures, which must be met in order to determine the amount of payout, vesting, or both of such award. Performance measures would be established by the Committee based on business criteria or other relevant performance metrics.

Federal Income Tax Consequences

Stock Options

Incentive Stock Options. Under current federal income tax laws, an option holder does not recognize income and ChoiceOne does not receive a deduction at the time an incentive stock option is granted or at the time the incentive stock option is exercised, assuming certain requirements are met. However, the difference between the market value of the common stock subject to the incentive stock option and the exercise price would be a tax preference item for such option holder’s purposes of calculating alternative minimum tax. Upon the sale or other disposition of the common stock acquired pursuant to an incentive stock option, as long as (i) the option holder held the stock for at least one year after the exercise of the stock option and at least two years after the grant of the stock option, and (ii) the stock option is exercised not later than three months after termination of employment (one year in the event of disability), the option holder’s basis equals the exercise price and the option holder would pay tax on the difference between the sale proceeds and the exercise price as capital gain. ChoiceOne receives no deduction for federal income tax purposes under these circumstances. Special rules apply when an option holder dies.

If an option holder fails to meet any of the conditions described above relating to holding periods and exercises following termination of employment, he or she generally would recognize compensation taxed as ordinary income equal to the difference between (i) the lesser of (a) the fair market value of the common stock acquired pursuant to the stock option at the time of exercise, or (b) the amount realized on the sale or disposition, and (ii) the exercise price paid for the stock. ChoiceOne would then receive a corresponding deduction for federal income tax purposes, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply. Additional gains, if any, recognized by the option holder would result in the recognition of short- or long-term capital gain.

Nonqualified Stock Options. Federal income tax laws provide different rules for nonqualified stock options – those options that do not meet the Internal Revenue Code’s definition of an incentive stock option. Under current federal income tax laws, an option holder would not recognize any income and ChoiceOne would not receive a deduction when a nonqualified stock option is granted. If a nonqualified stock option is exercised, the option holder would recognize compensation income equal to the difference between the exercise price paid and the market value of the stock acquired upon exercise (on the date of exercise). ChoiceOne would then receive a corresponding deduction for federal income tax purposes, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply. The option holder’s tax basis in the shares acquired is the exercise price paid plus the amount of compensation income recognized. Sale of the stock after exercise would result in recognition of short-term or long-term capital gain (or loss).

Stock Appreciation Rights

Under current federal income tax laws, stock appreciation rights that are payable solely in the form of ChoiceOne common stock permit a participant to not recognize any income and ChoiceOne would not receive a deduction at the time such a stock appreciation right is granted. If a stock appreciation right is exercised, the participant would recognize compensation income in the year of exercise in an amount equal to the difference between the base or settlement price and the market value of the stock subject to the stock appreciation right (on the date of exercise). ChoiceOne would receive a corresponding deduction for federal income tax purposes. The participant’s tax basis in the shares acquired would be increased over the exercise price by the amount of compensation income recognized. Sale of the stock after exercise would result in recognition of short- or long-term capital gain or loss. Federal income tax laws provide different rules for stock appreciation rights that are payable in cash than for those that are payable solely in the form of ChoiceOne common stock. Under current federal income tax laws, a participant would not recognize any income and ChoiceOne would not receive a deduction at the time such a stock appreciation right is granted. Depending on the terms of the stock appreciation right, a participant may recognize taxable income upon the vesting of a cash-settled stock appreciation right and may also be subject to additional excise taxes and penalties. ChoiceOne would receive a corresponding deduction in any year in which the participant recognizes taxable income.

Restricted Stock and Restricted Stock Units

Generally, under current federal income tax laws a participant would not recognize income upon the award of restricted stock or restricted stock units. However, a participant would be required to recognize compensation income at the time the award vests (when the restrictions lapse) equal to the difference between the fair market value of the stock at vesting and the amount paid for the stock (if any). At the time the participant recognizes compensation income, ChoiceOne would be entitled to a corresponding deduction for federal income tax purposes, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply. If restricted stock or restricted stock units are forfeited by a participant, the participant would not recognize income with respect to the forfeited award and ChoiceOne would not receive a corresponding deduction. Prior to the vesting and lapse of restrictions, dividends paid on shares subject to awards of restricted stock and restricted stock units would be reported as compensation income to the participant and ChoiceOne would receive a corresponding deduction, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply.

A participant could, within 30 days after the date of an award of restricted stock (but not an award of restricted stock units), elect to report compensation income for the tax year in which the restricted stock is awarded. If the participant makes this election, the amount of compensation income would be equal to the difference between the fair market value of the restricted stock at the time of the award and the amount paid for the stock (if any). Any later appreciation in the value of the restricted stock would be treated as capital gain and recognized only upon the sale of the shares subject to the award of restricted stock. Dividends received after such an election would be taxable as dividends and not treated as additional compensation income. If, however, restricted stock is forfeited after the participant makes such an election, the participant would not be allowed any deduction for the amount that he or she earlier reported as income. Upon the sale of shares subject to the restricted equity award, a participant would recognize capital gain or loss in the amount of the difference between the sale price and the participant’s basis in the stock.

Stock Awards

The recipient of an equity award generally would recognize compensation income equal to the difference between the fair market value of the stock when it is awarded and the amount paid for the stock (if any). The recipient’s tax basis in the stock would equal the amount of compensation income recognized on the award plus the amount paid by the recipient for the stock (if any). ChoiceOne would be entitled to a corresponding deduction equal to the amount of compensation income recognized by the recipient, except to the extent that the deduction limits of Section 162(m) of the Internal Revenue Code apply. Upon a subsequent sale of the stock, the recipient would recognize capital gain or loss equal to the difference between the amount realized on the sale and his or her basis in the stock. Different rules may apply where the stock is transferred subject to a “substantial risk of forfeiture.”

ChoiceOne Tax Consequences

Section 162(m) of the Internal Revenue Code, as amended, limits to $1,000,000 the annual income tax deduction that a publicly-held Company may claim for compensation paid to certain “covered employees” as defined in Section 162(m). Previously, qualified “performance based” compensation was exempt from the $1,000,000 limit and could be deducted even if other compensation exceeded $1,000,000.

Effects of a Change in Control of ChoiceOne

Upon the occurrence of a “change in control” of ChoiceOne (as defined in the Incentive Plan), all outstanding stock options and stock appreciation rights would vest and become exercisable in full immediately prior to the effective time of the change in control and would remain exercisable in accordance with their terms. All Performance Measures or other vesting criteria related to outstanding Performance Share Awards would be deemed to have been satisfied at 100% of target levels and such Performance Shares Awards would become vested and exercisable immediately prior to the effective time of the change in control. All other outstanding incentive awards under the Incentive Plan would immediately become fully vested, exercisable and nonforfeitable. In addition, the Personnel and Benefits Committee, without the consent of any affected participant, could determine that some or all participants holding outstanding stock options and/or stock appreciation rights would receive, in lieu of some or all of such awards, cash in an amount equal to the highest price per share actually paid in connection with the change in control over the exercise price of the stock options and/or the base price per share of the stock appreciation rights.

Tax Withholding

If incentive awards are made under the Incentive Plan, ChoiceOne could withhold from any cash otherwise payable to a participant or require a participant to remit to ChoiceOne amounts necessary to satisfy applicable withholding and employment-related taxes. Unless the Personnel and Benefits Committee determines otherwise, tax withholding obligations could also be satisfied by withholding ChoiceOne common stock to be received upon exercise or vesting of an incentive award or by delivering to ChoiceOne previously owned shares of common stock. ChoiceOne may reasonably delay the issuance or delivery of shares of ChoiceOne common stock pursuant to an incentive award as it determines appropriate to address tax withholding and other administrative matters.

Termination and Amendment of the Incentive Plan or Awards

The board of directors could terminate the Incentive Plan at any time and could from time to time amend the Incentive Plan as it considers proper and in the best interests of ChoiceOne, provided that no such amendment could be made (except adjustments expressly permitted by the Incentive Plan) without the approval of shareholders of ChoiceOne if it would (i) reduce the exercise price of a stock option or the base price of a stock appreciation right below the market value of the underlying stock on the date of the grant, (ii) reduce the exercise price of outstanding stock options or the base price of outstanding stock appreciation rights, (iii) increase the individual annual maximum award limit, or (iv) otherwise amend the Incentive Plan in any manner requiring shareholder approval by law or requirements or rules of any national securities exchange on which ChoiceOne shares are traded or in a manner such that the Incentive Plan would not comply with Section 409A of the Internal Revenue Code. In addition, no amendment to the Incentive Plan or to a previously granted incentive award could impair the rights of a holder of any outstanding incentive award without the consent of the participant, except in certain circumstances in which such amendment is required or advisable to satisfy a law or regulation or to meet the requirements of or avoid adverse financial accounting consequences under any tax or accounting standard, law or regulation.

Effective Date of the Incentive Plan

Subject to shareholder approval, the Incentive Plan would become effective as of February 23, 2022, and, unless terminated earlier by the board of directors, no awards could be made under the Incentive Plan after February 23, 2032.

If the Incentive Plan is not approved by the shareholders, no incentive awards will be made under the Incentive Plan to any employee.

Registration of Shares

ChoiceOne intends to register shares covered by the Incentive Plan under the Securities Act of 1933 before any stock options or stock appreciation rights could be exercised and before any shares of restricted stock, restricted stock units, equity awards or other stock-based or stock-related awards are granted.

Your Board of Directors recommends that you

vote FOR the approval of the ChoiceOne Financial Services, Inc. Equity Incentive Plan of 2022.

Approval of the 2022 Employee Stock Purchase Plan

The Company is requesting that its shareholders approve the ChoiceOne Financial Services, Inc. 2022 Employee Stock Purchase Plan (the “Purchase Plan”). The board of directors believes the Purchase Plan is important to further encourage and enable ownership of the Company’s common stock by employees and thereby align the interests of employees with those of the Company’s shareholders. Accordingly, on March 23, 2022, the board of directors adopted and approved, subject to shareholder approval, the ChoiceOne Financial Services, Inc. 2022 Employee Stock Purchase Plan. The Purchase Plan replaces in its entirety the ChoiceOne Financial Services, Inc. 2002 Employee Stock Purchase Plan ("2002 Purchase Plan"), and no further shares are available or will be issued under the 2002 Purchase Plan following approval of the Purchase Plan by shareholders.

The Purchase Plan is intended to qualify as an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code. The following is a summary of the material features of the Purchase Plan; however, it is not complete and, therefore, you should not rely solely on it for a detailed description of every aspect of the Purchase Plan. The summary is qualified in its entirety by reference to the terms of the Purchase Plan, a copy of which is attached as Appendix B to this proxy statement.

Purpose of the Purchase Plan

The purpose of the Purchase Plan is to further encourage employees of the Company and the Company’s Subsidiaries to promote the best interests of the Company and align the interests of employees with the Company’s shareholders by permitting eligible employees to purchase shares of the Company’s common stock. Additionally, the Purchase Plan is also intended to encourage employees to continue their employment with the Company and its subsidiaries.

Subject to customary anti-dilution adjustments, 200,000 shares of the Company’s common stock are authorized for issuance for purchase under the Purchase Plan. The shares subject to the Purchase Plan include shares currently authorized but unissued and shares repurchased by the Company in the open market or in private transactions.

All active employees of the Company or its subsidiaries (including the Bank) are eligible to participate in the Purchase Plan, except those: (1) whose customary employment by the Company or its subsidiaries is for five months or less in a calendar year; or (2) who are citizens or residents of a foreign jurisdiction under the following circumstance: (i) the grant under the plan or offering to a citizen or resident of the foreign jurisdiction is prohibited under the laws of such jurisdiction; or (ii) compliance with the laws of the foreign jurisdiction would cause the Purchase Plan or offering to violate the requirements of the Code. An employee’s eligibility will be determined as of the first day of the election period for each option period.

Participation in the Purchase Plan

There will be four consecutive option periods of three months each under the Purchase Plan in each year, beginning on January 1, April 1, July 1, and October 1. An eligible employee may become a participant in the Purchase Plan for the next option period by delivering an election form to the Company prior to the beginning of the option period. Once an option period is ended, a participant will automatically be enrolled in the next option period unless the participant elects to withdraw from the Purchase Plan, as described below.

The election form will authorize the Company to make regular payroll deductions from the employee’s compensation to be used for the purchase of stock pursuant to the Purchase Plan. The employee may authorize deductions of not less than $10 and not more than $750 from the employee’s compensation for each pay period. A participant may increase or decrease the participant’s elected deductions by delivering a new election form to the Company, and such modification will take effect as of the beginning of the next option period. The purchase price of each share purchased under the Purchase Plan will be least 85% of the market value of the shares of Company common stock on the share purchase date or such price as the Personnel and Benefits Committee may determine in its sole discretion from time to time.

Limitations on Participation

A participant may not purchase shares of stock under the Purchase Plan at a rate that exceeds $25,000 of market value of stock in any one calendar year, and for any calendar year where the purchase price is below market value, this limit shall be prorated by the percentage that matches the percentage of the purchase price discount. In no event, will rights accrue at a rate that exceeds that permitted by the Internal Revenue Code. In addition, no participant is permitted to purchase stock under the Purchase Plan if the participant, immediately after purchasing stock, would own stock possessing five percent or more of the total combined voting power or value of all classes of stock of the Company or any subsidiary.

Termination of Participation

A participant may elect at any time before a share purchase date to withdraw from participation in the Purchase Plan and withdraw the balance accumulated in his or her share purchase account upon proper notice to the Company.

Generally, if a participant retires, dies, terminates employment, becomes disabled or takes a leave of absence that meets certain requirements (where disability or leave of absence has continued for at least three months or leave is without pay or income replacement benefits), or is otherwise no longer eligible to participate in the Purchase Plan, no further payroll deductions will be made for that participant, and the balance in the participant’s share purchase account would be paid to the participant or, in the event of the participant’s death, his or her estate or beneficiaries.

Administration of the Purchase Plan

The Purchase Plan will be administered by the Personnel and Benefits Committee. The Personnel and Benefits Committee may delegate certain administrative functions to a designated broker, outside vendor, or certain other designated individuals.

Amendment and Termination of the Purchase Plan

The Personnel and Benefits Committee or the Board may amend the Purchase Plan at any time, provided that no amendments that would cause the Purchase Plan to fail to meet the requirements of Section 423 of the Internal Revenue Code or that would require shareholder approval pursuant to the Internal Revenue Code shall become effective until approved by the shareholders. The Board may terminate the Purchase Plan at any time.

Certain Federal Income Tax Consequences

The following is a summary of the general income tax consequences of participation in the Purchase Plan. This information is not a complete summary of such tax laws and does not discuss the income tax laws of any state in which a participant may reside or the tax consequences at a participant’s death, and is subject to change. Participants in the Purchase Plan should consult their own tax advisors regarding the specific tax consequences to them of participating in the Purchase Plan.

The Purchase Plan is intended to qualify as an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code. Accordingly, no income will be taxable to a participant until the shares purchased under the Purchase Plan are sold or otherwise disposed of.

If the shares are sold or otherwise disposed of within two years after the first day of the applicable option period or within one year of the purchase date of the shares, then the participant will recognize ordinary income in the year of the sale or disposition equal to the amount by which the market value of the Company’s common stock on the purchase date exceeded the purchase price paid for those shares, and the Company will be entitled to an income tax reduction for such year equal to such excess. The participant will also recognize a capital gain to the extent the amount realized upon sale or disposition of the shares exceeds the sum of the aggregate purchase price for the shares and the ordinary income recognized in connection with the acquisition.

If the shares are sold more than two years after the first day of the applicable option period and more than one year after the purchase date of the shares, then the participant will recognize ordinary income in the year of the sale or disposition equal to the lesser of (1) the amount by which the fair market value of the Company’s common stock at the time of such sale or disposition exceeds the purchase price paid for the shares, and (2) the amount by which the fair market value of the Company’s common stock on the first day of the applicable option period exceeds the purchase price on such date. Any additional gain upon the sale or disposition will be taxed as a long-term capital gain, and the Company will not be entitled to an income tax deduction with respect to such disposition.

Effective Date of the Purchase Plan

Subject to shareholder approval, the Purchase Plan would become effective on May 25, 2022, and will remain in effect until terminated by the Board.

Your Board of Directors recommends that you

vote FOR the approval of the ChoiceOne Financial Services, Inc. 2022 Employee Stock Purchase Plan.

Advisory Approval of Executive Compensation

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934 (the "Act"“Act”), shareholders may cast an advisory vote on the approval of the compensation of the Company's named executive officers as disclosed in this proxy statement pursuant to the SEC's compensation disclosure rules. The Company has designed its executive compensation programs to attract, motivate, reward, and retain senior management talent, and to encourage senior management to manage the Company to achieve our corporate objectives and increase shareholder value through long-term profitable growth. The Personnel and Benefits Committee, which consists entirely of independent directors, oversees the compensation of the Company's named executive officers. The Personnel and Benefits Committee believes that the Company's compensation programs are appropriate for the Company taking into account such factors as the size of the Company and ChoiceOne Bank, the market for executive talent in which we compete, and the Company's short-term and long-term strategic objectives. The Personnel and Benefits Committee believes that the Company's compensation programs strike an appropriate balance between incentivizing growth while not encouraging excessive risk-taking. For these reasons, we are recommending that our shareholders vote "FOR"“FOR” the adoption of the following resolution:

RESOLVED, that the shareholders of ChoiceOne Financial Services, Inc. (the "Company"“Company”) approve the compensation of the Company's named executive officers, as disclosed in the Company's proxy statement for the 20222024 Annual Meeting of Shareholders under the heading entitled "Executive“Executive Compensation."

”

This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy and programs described in this proxy statement.

The vote is not binding on the Company, the Board of Directors or the Personnel and Benefits Committee. However, the Board of Directors and Personnel and Benefits Committee value the opinions of our shareholders and will take the results of the vote into consideration when making future decisions regarding executive compensation.

The Company's current policy is to provide shareholders with an opportunity to approve the compensation of the named executive officers each year at the annual meeting of shareholders. The next such vote will occur at the 20232025 annual meeting of shareholders.

Your Board of Directors and Personnel and Benefits Committee, which consists entirely of independent directors,

recommend that you vote FOR the approval of the compensation of the Company's named executive officers.

Ratification of the Selection of Independent Registered Public Accounting Firm

ChoiceOne's Audit and Compliance/CRA Committee ("(“Audit Committee"Committee”) has approved the selection of Plante & Moran, PLLC as the Company's independent registered public accounting firm to audit the financial statements of ChoiceOne and its subsidiaries for the year ending December 31, 2022,2024, and to perform such other appropriate accounting services as may be approved by the Audit Committee. The Audit Committee and the Board of Directors propose and recommend that shareholders ratify the selection of Plante & Moran, PLLC to serve as the Company's independent auditors for the year ending December 31, 2022.2024. More information concerning the relationship of the Company with its independent auditors appears below under the headings "Audit“Audit Committee," "Independent” “Independent Registered Public Accounting Firm,"” and "Audit“Audit Committee Report."

”

If the shareholders do not ratify the selection of Plante & Moran, PLLC, the Audit Committee will consider a change in auditors for the next year.

Your Board of Directors and Audit Committee, which consists entirely of independent directors,

recommend that you vote FOR ratification of the selection of Plante & Moran, PLLC as our independent auditors for 2022.2024.